minnesota unemployment income tax refund

So far the refunds are averaging more than 1600. The 10200 tax break is the amount of income exclusion for single filers not the amount of the refund.

Tax Changes What S New For Filing Taxes At The Irs In 2022 Money

The refund will go to your client employer.

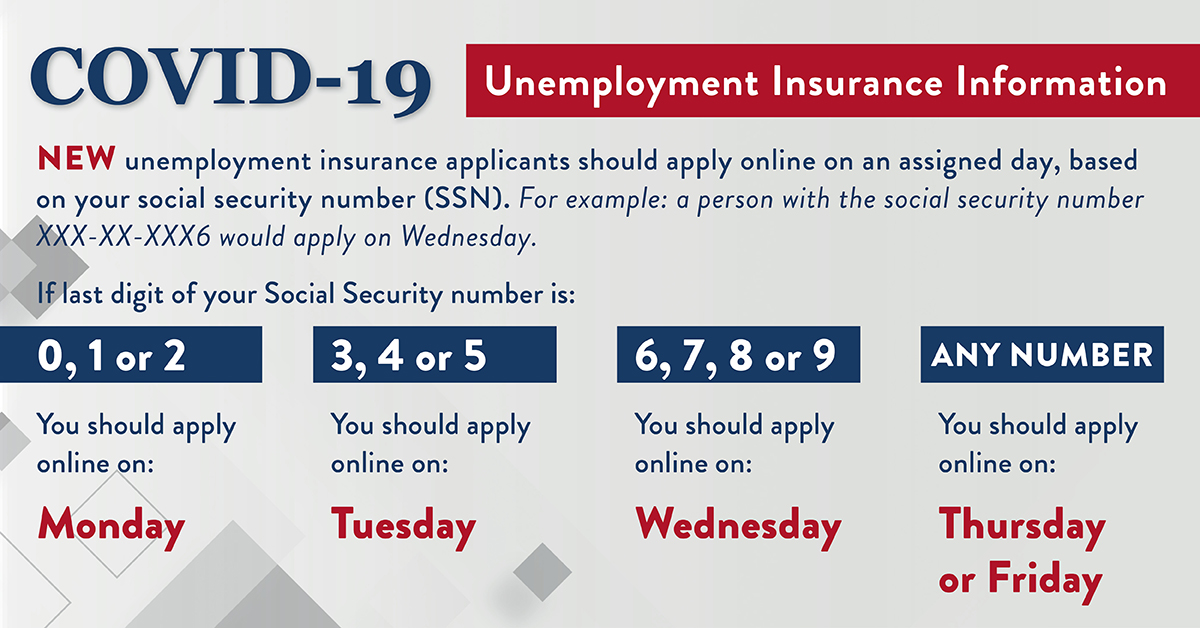

. September 15 2021 by Sara Beavers. The American Rescue Plan Act of 2021 excluded up to 10200 in unemployment compensation per taxpayer from taxable income paid in 2020. The 10200 is the amount of income exclusion for single filers not the amount of the refund.

Paul MN 55145-0020 Mail your tax questions to. On Thursday September 9 th the Minnesota Department of Revenue announced the processing of returns impacted by the tax law changes made for the treatment of unemployment insurance compensation will begin the week of September 13 th. Report the federally excluded amount on line 7 of Schedule M1NC Federal Adjustments.

Minnesota Department of Revenue Mail Station 5510 600 N. Base Tax Rate for 2022 from 050 to 010. Additional Assessment for 2022 from 1400 to 000.

The Center Square The Minnesota Department of Revenue will start sending out more than 540000 tax returns impacted by tax law changes to Unemployment Insurance compensation and Paycheck Protection Program loan forgiveness. The new law reduces the. You have the option of having income tax withheld from your unemployment benefits so you dont have to pay it all at once when you file your tax returnbut it wont happen automatically.

- The Minnesota Department of Revenue announced today that the processing of returns impacted by tax law changes made to the treatment of Unemployment Insurance compensation and Paycheck Protection Program loan forgiveness will begin the week of September 13. Without that law Minnesota businesses were set to suffer a 30 increase in their unemployment taxes triggered when the fund is below a certain threshold. Paul MN 55145-0010 Mail your property tax refund return to.

A spokesman for the Minnesota Department of Revenue said taxpayers dont need to take. Well if you were on unemployment for a week last year youll probably get somewhere between 50 and 100. While the state withheld taxes on regular unemployment benefits which are taxed like regular incomeit did not withhold taxes from the extra 600 weekly payments from the CARES Act and the 300.

This is not the amount of the refund taxpayers will receive. The Minnesota Department of Revenue. Surprise checks before New Years Eve.

Minnesota Department of Revenue Mail Station 0010 600 N. But if you were unemployed for several months it could be hundreds of dollars. September 09 2021.

If you excluded any unemployment compensation on your federal return you must add it back on your Minnesota return. Taxpayers should not have been taxed on up to 10200 of the unemployment compensation. Minnesota Unemployment Refund Update.

This means if it takes the IRS the full 21 days to issue your check and your bank five days to post it you could be waiting a total of 26 days to. The department has processed about 524000 of the impacted returns now out of a total of 542000 with an average refund currently at 581 according to The Sun. If your client has assigned you with the Tax Payment Update and Submit role you can request a refund on their behalf.

How to calculate your unemployment benefits tax refund. The agency is manually processing about 1000 individual income tax returns per week to start with the goal of increasing that to 50000 returns per week by late October. Tax rate information.

The Minnesota Department of Revenue announced last week that about 1000 refunds will go out this week a process that officials hope will ramp up to roughly 50000 per week by late October. Up to 10200 of extra unemployment benefits are also tax-free for people making less than 150000 per year. Mail your income tax return to.

Minnesota Department of Revenue Mail Station 0020 600 N. The new law reduces the amount of unemployment tax and assessments a taxpaying employer will owe in 2022. The amount of the refund will vary per person depending on overall income tax bracket and how much earnings came from unemployment benefits.

If your client has not assigned this role to you please advise them to request a refund from within their UI employer account or contact Customer Service for assistance. The Minnesota State Capitol in Saint Paul Minnesota. Withheld amounts appear in box 4 of your Form 1099-G.

The Minnesota Legislature has passed and Governor Walz has signed into law a Trust Fund Replenishment bill. The Minnesota State Capitol in Saint Paul Minnesota. Tax rate information.

You must complete and submit Form W-4V to the authority thats paying your benefits. Credit adjustments refunds. Taxable wage and rate information.

Include the amount in your total unemployment compensation on line C of Form M1 Individual Income Tax. State lawmakers managed to pass the law SF 2677 the day before the April 30 deadline to submit taxes but alas some businesses had already paid their quarterly taxes at the higher rate.

3 21 3 Individual Income Tax Returns Internal Revenue Service

News Minnesota Department Of Employment And Economic Development

Will There Be Any Federal Unemployment Benefit Extensions In 2022 For Expired Pua Peuc And Extra 300 Fpuc Programs News And Updates On Missing And Retroactive Back Payments Aving To Invest

Can An Unemployed Person File A Federal Tax Return

Irs Tax Refunds What Is Irs Treas 310 Marca

Minnesota Guidance On Federal Unemployment Compensation Exclusion

3 21 3 Individual Income Tax Returns Internal Revenue Service

3 21 3 Individual Income Tax Returns Internal Revenue Service

Will There Be Any Federal Unemployment Benefit Extensions In 2022 For Expired Pua Peuc And Extra 300 Fpuc Programs News And Updates On Missing And Retroactive Back Payments Aving To Invest

2022 Average Irs And State Tax Refund And Processing Times Aving To Invest

Unemployment Fraud Penalties What You Need To Know Khouri Law

Covid 19 Policy Updates Minnesota Chamber Of Commerce

Frontline Workers Will Get Bonus Checks By Summer Mn Officials Say Boreal Community Media

3 21 3 Individual Income Tax Returns Internal Revenue Service

2021 Taxes A Comprehensive Guide To Filing Money

How To Claim Unemployment Benefits H R Block

Hb 1302 Tax Refund Schedule Can Your Tax Refund Be Deposited On Sunday Marca